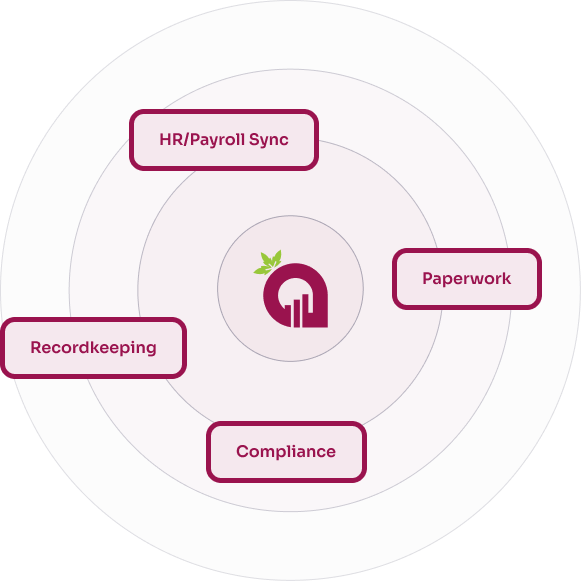

End-to-end administration

Industries

Where hourly workers are present OR for dynamic compensation plans!

Healthcare

Education

Retail

Logistics

Hospitality

Manufacturing

Distribution

"A 401(k) doesn't work well for lower income employees because most can' t afford the pay deductions."

Introducing: Radish

The Radish Plan is a cost-effective way for employers to help make these employees more financially secure.

This plan is totally flexible including which employees will be eligible and the reasons why they will be rewarded. Options include continuing employment, meeting performance and/or safety standards etc.

Why Choose Us?

401K plans are outdated, underutilized, and do not ensure employee loyalty.

Over 60% of Americans are living check-to-check. Expecting employee contributions to a plan that is out of their reach is unrealistic. High inflation, lingering student loans, rising housing costs are just some of the challenges for your staff.

Learn How The Radish Plan is Redefining Employee Benefits!

Services

The Radish Plan supports employers who are seeking to Recruit, Reward, and Retain the best talent.

Don't take our word for it!

Review the respected media coverage of Ted Benna below.

He is the famous founder, innovator, and designer behind The Radish Plan.

Use Case

A typical case study using the Radish model

XLC LLC, an HVAC company, employed 167 employees in two locations. The company culture centered around a mission to provide lifetime employment to the local community with secure retirement exits down the line. The primary obstacle emerged from a high cost of living and an average salary of $55,000, which left little to nothing after tax for 401K contributions. The 401k program was complex, expensive, difficult to manage and they saw low participation rates.

Save 15.3% on Payroll Taxes While Boosting Performance

The first IRS-approved performance incentive plan that eliminates employer payroll taxes and drives measurable results

Who We Are

Credited as the "Father of the 401(k)," Ted Benna is the visionary behind the Radish Plan—an incentive-based model designed to help businesses retain top talent, increase profitability, and provide real financial security for employees.

He saw firsthand that traditional benefits fall short in meeting the urgent needs of today’s businesses.

That’s why he created the first employer-backed qualified fund—tax-deductible, fully customizable, and designed to reward employees while strengthening your bottom line.

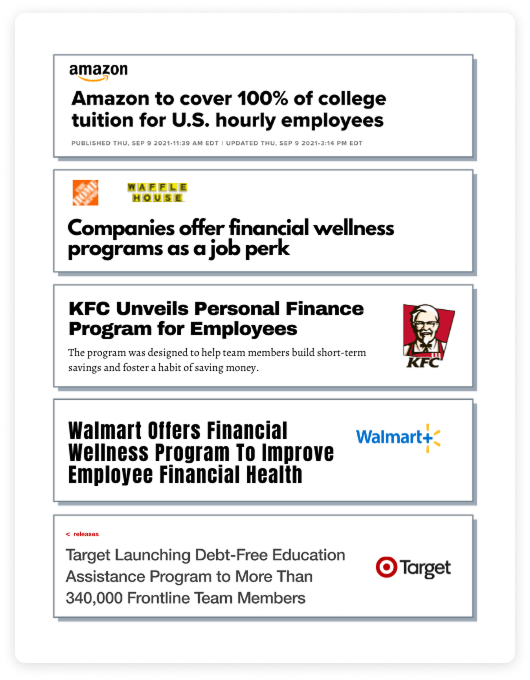

The Benefits Shift

Over 60% of Americans are living check-to-check. Expecting employee contributions to a plan that is out of their reach is unrealistic. High Inflation, lingering student loans, rising housing costs are just some of the challenges for your staff.

401K plans are outdated, underutilized, and do not ensure employee loyalty

Why Incentives Work

The data doesn’t lie: well-designed incentive plans can

boost productivity by 22%,

increase engagement 4x, and

slash turnover by 15%. Motivated teams deliver more—for your business and your bottom line.

The Proof

- 22% Productivity Surge: Performance-based incentives deliver top-tier output, per NBER research.

- 4x More Engagement: Employees who feel valued give their all, says Achievers’ studies.

- 15% Less Turnover: Keep your best talent longer with rewards that work.

"The data was pretty clear for us, the stores using the incentive plan had a 62% reduction in turnover. If we are turning over less then we know the culture is better there. We can replicate this across the board now."

Matt - National QSR CFO

"Our engagement went through the roof once we implemented our incentive plan solely based on hours worked. After 6 months, our turnover was half the national average."

Steve - Home Healthcare

Introducing Radish

Unlock your team’s potential with a game-changing incentive program that celebrates their hard work.

Radish empowers your employees to earn more, achieve more, and stay committed—all while driving your business forward.

The only incentive program on the market that allows you to use TAX DEFERRED funds -No FICA, Unemployment, or Workmans Comp-

How much will your company soar when performance powers a culture of success and rewards?

Tax Savings Calculator

Discover how much your company can save with The Radish Plan

The only incentive program that uses tax-deferred funds with no FICA, Unemployment, or Workers Comp taxes

Current Payroll Tax Burden

Current Annual Cost

Radish Plan Cost

Your Annual Tax Savings

Plus improved performance, retention, and employee engagement

Return on Investment

Monthly Tax Savings

Annual Cost Per Employee

Proven Benefits Beyond Tax Savings

Ready to Start Saving?

Join companies already boosting productivity by 22% while saving on taxes

Built for Today's Businesses

Expert plan set up

Endless distribution opportunities

Withdrawal safeguards

Coordinated launch

Distribute daily, weekly, monthly, for performance, etc

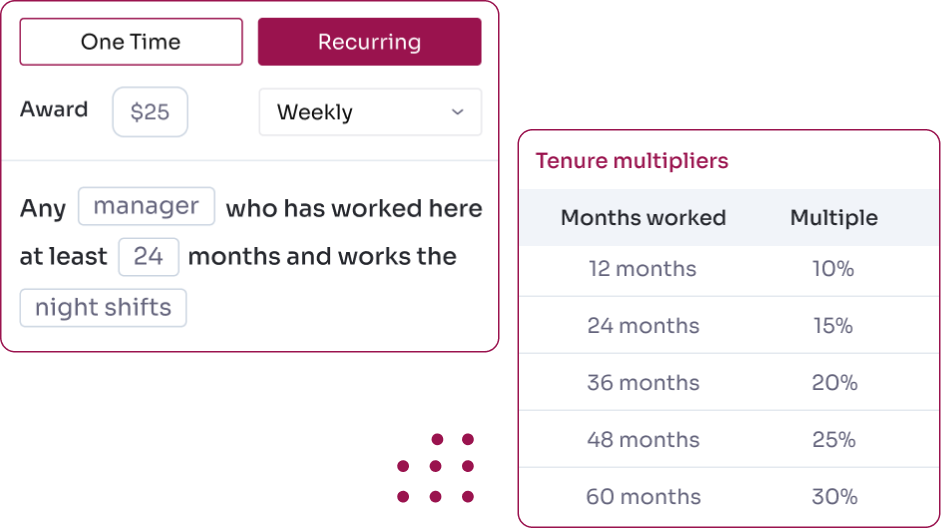

Dialed in

Tailored earning and withdrawal

Set one-time or recurring earning distributions

Tenure multiples

Set withdrawal minimums and time limitations

Relaxed withdrawal hardship claims

Never worry about your retention strategy again

Benefits for Employers

Simplified retirement plan 100% funded by you

Use as a performance reward system

Help retain and keep employees

Boost moral and overall health of the workforce

Ask us about the tax credits that make The Radish Plan available at no cost.

Don’t have a plan in place yet?

Let's Chat about Radish

We're here to help you secure your employees' financial future.

Headquarters

12368 Market Drive Oklahoma City, OK 73114

Call Us

(405) 580-9934

Tell Us About Your Organization

Submit Your Info

Please try again later.

Blog

Lorem ipsum dolor sit amet consectetur.

Lorem ipsum dolor sit amet consectetur. Suspendisse feugiat pharetra at at. At sagittis pretium integer non tincidunt tristique.

Read More

Lorem ipsum dolor sit amet consectetur.

Lorem ipsum dolor sit amet consectetur. Suspendisse feugiat pharetra at at. At sagittis pretium integer non tincidunt tristique.

Read More

Lorem ipsum dolor sit amet consectetur.

Lorem ipsum dolor sit amet consectetur. Suspendisse feugiat pharetra at at. At sagittis pretium integer non tincidunt tristique.

Read More

Blog

This is the text area for this paragraph. To change it, simply click and start typing. Once you've added your content, you can customize its design. This is the text area for this paragraph.

Name Surname

Position, Company Name

“ This app gives me peace of mind knowing exactly how much my work savings account is growing. It’s so easy to use, and I love getting real-time updates about my balance. It's helped me stay motivated and on track with my financial goals! ”

Name Surname

Position, Company Name

This is the text area for this paragraph. To change it, simply click and start typing. Once you've added your content, you can customize its design. This is the text area for this paragraph.

Name Surname

Position, Company Name

This is the text area for this paragraph. To change it, simply click and start typing. Once you've added your content, you can customize its design. This is the text area for this paragraph.

Name Surname

Position, Company Name

“ This app gives me peace of mind knowing exactly how much my work savings account is growing. It’s so easy to use, and I love getting real-time updates about my balance. It's helped me stay motivated and on track with my financial goals! ”

Name Surname

Position, Company Name

Testimonials

Frequently Asked Questions

Must the IRS approve the plan?

An IRS approved prototype or a custom designed plan document must be adopted by each employer. The Wagner Law Group, one of the countries leading ERISA firms, has prepared a simplified prototype. They will also prepare a customized document if you prefer.

What design options do we have?

There are very few rules that must be followed. As a result, the plan can be designed however you wish, and we will help you do that. We will then prepare what is needed to implement the plan.

Which employees are eligible?

The primary goal for this plan is to help middle to low-income employees by giving them incentives that will be contributed into an actual qualified retirement plan account. The plan can cover all employees who own less than 5% of the business or who make less than $155,000 per year. You have complete freedom to decide which of these employees will be eligible.

Can I adopt this plan if we already have a plan?

Yes, you may do so regardless of which type of plan you currently offer.

Can this be part of our 401(k) plan?

Yes, it can be, but there are many reasons why a separate plan is probably your best option. We will gladly discuss this with you.

Can we start the plan anytime?

The first day of the month is the best time and you can pick any month you want.

What if we don’t get the results we want?

The plan can be terminated at any time.

What type of plan is the Radish Plan?

It's a 401(a) qualified retirement plan that is totally employer-funded. Since it covers only non-highly compensated employees (NHCEs), it can be designed however the employer wants, including which employees to cover and how they get contributions.

Who provides the legal framework?

The Wagner Law Group has done all the legal work and provided their legal blessing. They've prepared a prototype document with an adoption agreement that's only a couple of pages long with minimal decisions to make.

Who has fiduciary responsibility?

There is essentially no fiduciary risk since all money goes into a money market fund. There's no fund selection process required.

Is there compliance testing required?

No. There's no compliance testing, no discrimination testing at the end of the year. This is a very simplified plan compared to traditional 401(k)s.

How do employers save on payroll taxes?

Since these are qualified employer contributions to a retirement plan, they are exempt from FICA, unemployment, and workers' compensation taxes. This saves employers approximately 7.65% plus unemployment and workers' comp rates.

How is this different from 401(k) contributions regarding payroll taxes?

Employee contributions to 401(k) plans became subject to FICA taxes (probably in the 1986 Reconciliation Act). However, qualified employer contributions like those in the Radish Plan remain exempt from FICA taxes.

Are there tax consequences for employees when they withdraw?

Yes, withdrawals are subject to federal income tax and a 10% early distribution penalty if under age 59½, unless they qualify for penalty exemptions. However, withdrawals are not subject to FICA taxes and may not be subject to state and local taxes

What happens with plan-to-plan transfers?

Transfers from the Radish Plan to a 401(k) or IRA are direct trustee-to-trustee transfers with no taxable event. There's no 1099 generated for plan-to-plan transfers.

Does this have to be offered to all employees?

No. Since it excludes highly compensated employees (HCEs) and there are no discrimination issues to worry about, it can be designed however the employer wants, including which employees to cover and different classes that get rewarded in different ways.

How do employees earn contributions?

Contributions are 100% performance-based and tied to whatever performance standards the employer wants to establish - safety goals, on-time deliveries, customer satisfaction, attendance, productivity metrics, etc.

What happens to forfeitures if someone leaves?

There are two components: (1) The employer determines when contributions are actually made to the plan (vesting schedule), and (2) once money goes into the plan, it's 100% vested. So the employer can set time requirements before contributions are made, but once contributed, the money belongs to the employee.

Can employees access their money?

Yes, the money is more accessible than traditional 401(k) hardship withdrawals. Access is determined by employer-set criteria, and the plan is designed for employees to be able to tap into it for things like car repairs or unpaid medical expenses.

Are there investment options beyond money market?

Initially, all money goes into money market funds because employees have ready access and we don't want it at risk. However, the plan document provides that employees can transfer money to a 401(k) or IRA where it can be invested however they want for longer-term growth.

At what point can money be transferred for investment growth?

The employer can set the threshold amount at which money can be transferred to other plans for investment growth. This allows employees who accumulate significant amounts to move money for longer-term retirement planning.

Is this a mobile app or website?

It's mobile web-based - employees don't need to download anything. This avoids issues with app downloads and cellular service costs that some employees face.

How does the platform integrate with payroll systems?

The system integrates with over 200 different payroll and HR software systems through Finch. This provides automated employee census data and updates when employees are terminated or hired.

What does the employee interface look like?

It's gamified and shows current balance, earning campaigns (how they can earn money), past earnings, and importantly, potential earnings over the next 12 months to encourage retention.

What revenue sharing is available for partners?

Partners receive 20% of the monthly participation revenue, though this may need to be shared with financial advisors depending on the arrangement.

What marketing support is provided?

Complete marketing templates, industry-specific customization, co-branding opportunities, and direct support for presentations and demos. The team spends significant time preparing partners for success.

Who handles record keeping?

Radish handles all the record keeping through their platform. For custody and administration, accounts are set up at Broadridge, which handles things like annual notices and fee disclosures.

How are contributions processed?

Employers make contributions based on the performance metrics achieved. The system tracks which employees earned what amounts based on the campaigns and criteria set up in the platform.

What about annual reporting requirements?

Broadridge handles annual notices and fee disclosures electronically. The simplified plan structure minimizes ongoing compliance requirements.

What industries work best for this plan?

Any industry with measurable performance metrics works well. Primary focus has been trucking (safety, on-time delivery), but it also works for healthcare (patient satisfaction, attendance), sales organizations, manufacturing, construction, and service industries.

Can this work for 1099 contractors?

Yes, they're finishing development to allow IRA funding for 1099 contractors, which will enable sales organizations and other contractor-based businesses to participate.

Does this qualify for small employer tax credits?

Yes, small employers under 100 employees without existing qualified plans can use this to meet qualification standards for tax credits, including up to $1,000 per employee for contributions and administrative cost credits.

Do you have any other question?